How to Track and Improve Your DEI Hiring Metrics

9 minute read

Diversity, equity, and inclusion (often abbreviated as “DEI”, though they’re three separate things) are critical to modern hiring. Recruiters and hiring managers have a lot of power to make their companies and industries into better, more inclusive places to work.

Assessing and improving your DEI initiatives starts with effectively tracking demographic information about your candidates. Unfortunately, while you might know that this information is crucial, deciding how to track and measure it can be intimidating. Often, teams end up feeling paralyzed and not doing anything at all.

In this post, we'll walk you through your options for beginning to track demographic information, as well as show you how to report on it. With these metrics in place you'll be able to improve your DEI practices in no time.

A quick history of tracking demographic data in the U.S.

In the United States, demographic data is mostly tracked via Equal Employment Opportunity Commission (EEOC) questionnaires. To be compliant with U.S. government standards, certain private employers need to track EEO-1 data. Other countries have their own versions of this info, but for now we’ll focus on the U.S. While it started as a compliance tool, more and more companies are relying on this data to assess their performance on DEI.

Using EEOC data has a few common limitations:

- Because the questions are often just embedded in job applications, they may only be completed by applicants going through them - not current employees or applicants from other channels.

- The survey is voluntary, and concerns of discrimination or discomfort with personal disclosures can prevent applicants from filling it out.

- The standard questions are very limited, and don’t take into account all of the identities a single person could hold.

While EEOC data can be limiting it’s a good, clear place to start if you’ve never tackled DEI data collection before.

If you’d like to explore more advanced ways of collecting DEI data, there are plenty of ways to approach it.

The three approaches to collecting demographic data

There are three fundamentally different ways to start when it comes to tracking demographic data: candidate self-identification (“Candidate ID”), recruiter-led identification (“Recruiter ID”), and inference. You may get a different quantity or quality of data from each approach; no one is “better” than another, they’re simply different. We’ll explore each of the options and also touch on why it’s common to mix multiple approaches.

Candidate Self-Identification (“Candidate ID”)

One way to collect demographic data is by letting candidates volunteer information about themselves in the interview process. EEOC questions are one form of candidate ID.

Because these surveys are usually placed with the original job application form, you can run into a problem with sourced or referred candidates never seeing these questions. Some applicant tracking systems address this by supporting automatic survey requests at different stages and from all candidates, which can increase your completion rate.

An increasingly common alternative to using EEOC questions is creating a custom demographic survey where you choose the questions and answers yourself instead of relying on the government mandated form. This option is more available to companies who aren’t required to stick to and report on the base EEOC questionnaire.

Recruiter-Led Identification (“Recruiter ID”)

The second way to collect demographic data is recruiter ID, where a recruiter manually tags candidates with their demographic information. This is the most accurate and comprehensive approach, because your hiring team will personally ensure that each candidate is represented fully and accurately.

However, the manual nature of this approach can make it very time consuming. When a recruiting team is already on a time crunch or stretched thin, this relying on recruiter ID data can add to the workload. At Ashby, we often see customers use this approach for later stage candidates (e.g. only Offers/Hires) where they want the most details on someones demographics.

Inference

The third way to collect demographic data is using inference, where your hiring tool estimates the demographic information of the candidates who did not otherwise supply it. This data comes from census information and uses applicants’ names to try and fill in their gender and ethnicity.

The downside to this is that it isn’t perfect (Ashby's version is about ~80% accurate). The upside is that it can be applied to all candidates (including all of your historical data!) Because of that, for most teams, this is a very valuable data source to add in addition to Candidate or Recruiter ID.

Selecting your starting point

So which starting point is right for you? That depends on your needs and your team - one is not always better than another. If you have time to devote to it and need high accuracy, recruiter ID is your best bet (as mentioned above, we often see this focused on later stage candidates.) If you want a high degree of coverage and would like to review your historical performance, algorithmic inference will help a lot.

Don’t be afraid to hybridize! You can start with inference data and add candidate or recruiter ID later. Hybrid approaches tend to be the most effective, as one method can cover gaps left by another.

The most impactful DEI metrics

Now that you’ve started gathering data, you can dig into your performance. As we go forward, keep in mind that it’s not realistic to get all you need to know at once. Data improves and develops as it grows in volume over time. Furthermore, this information is a diagnostic tool. It’s all quantitative, or number-based data. To completely understand your DEI initiatives, you’ll need qualitative data, which will give you more specifics on how real people feel about your hiring process.

All this is to remind you not to grow discouraged if you start on DEI reporting and don’t see high volumes of perfect data in one week. Give it time, keep working on it. This is one of several tools, and you’re already off to a great start by having it set up.

With that out of the way, let’s look at the DEI metrics we recommend tracking.

Percent of hires from underrepresented groups

The first metric we’ll look at is percent of hires from underrepresented groups. To have an inclusive frame of mind, approach this metric as “more of X” rather than “less of Y,” i.e. you want to hire more women and nonbinary applicants, not fewer men. Track this metric both overall and by department to get a more comprehensive look at your company’s diversity standing.

When setting hiring goals, reference the distribution of the current market. If 24% of engineers are women, aiming for your engineering department to be a 50/50 gender split is going to be challenging, but aiming for 30% female hires is more attainable. Aim to set ambitious but realistic goals and do it with intention.

You need to track hiring percentages not only to see who you’re hiring, but to help you make sense of our next metric...

Conversion rates sliced by demographic data

Look at conversion rates from stage to stage. You want this to remain fairly consistent from one stage to the next across different underrepresented groups. This is an extremely important metric, as it’s a good way to spot problem areas in your hiring process. You may find that you begin with a more diverse range of candidate than you end up hiring, and that’s worth examining closer.

If you notice a big drop off in any of the groups you’re tracking from one stage to the next, that’s a sign that something exclusionary might be happening at that stage. Take time to investigate that stage and the source of the drop. Just like we mentioned at the start of this section, conversion between stages is an area where metrics can tell you that a problem exists, but only qualitative data can tell you why.

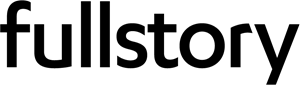

Percent of initial screens with diverse candidates

We recommend tracking the breakdown of your pipeline at the initial screen stage. This metric can be tracked nicely over time, making it a good indicator of success in creating a more diverse pool of candidates at the top of your funnel.

As with your final hiring metrics, look into industry numbers to get an idea of what goals you should set. Industry distributions are always a good place to start.

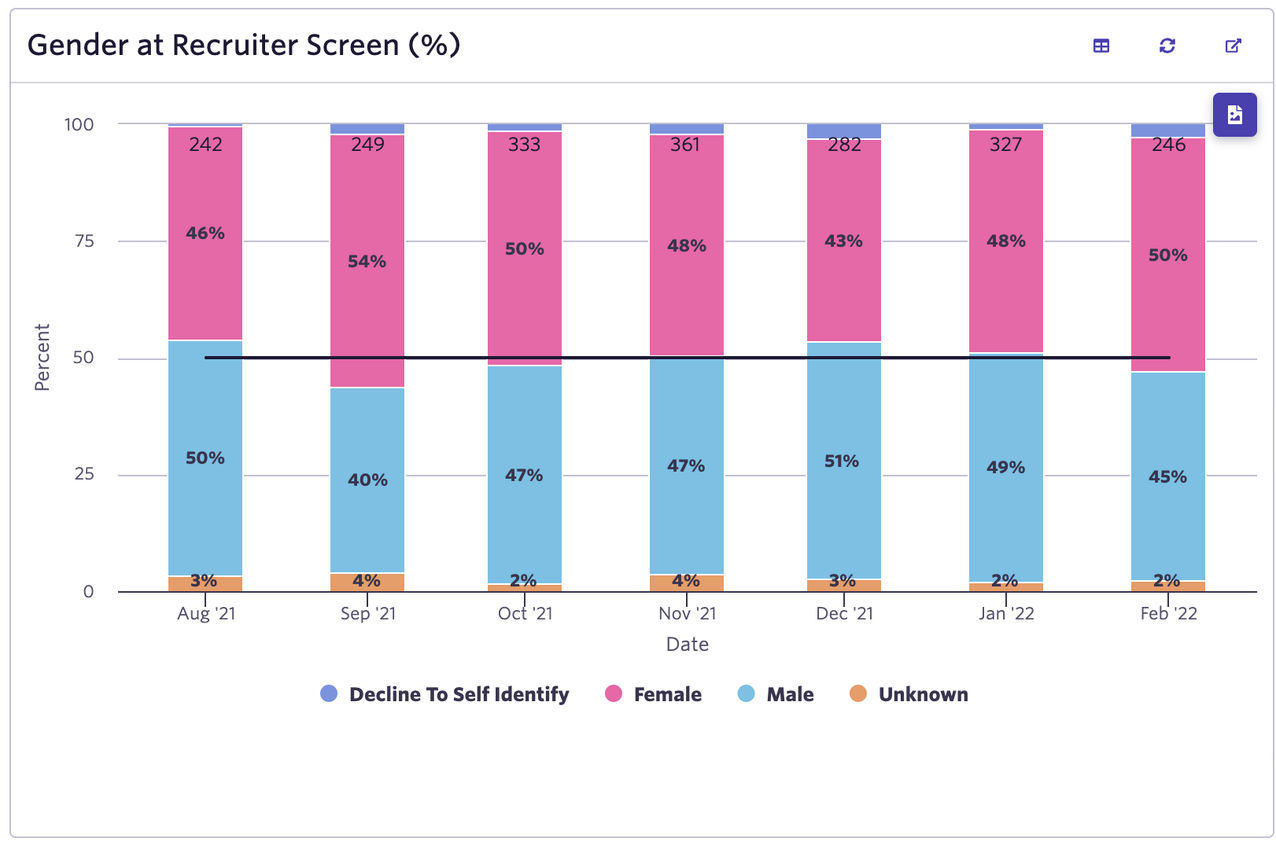

Percent of candidates sourced from different demographics

Finally, take yourself all the way to the top of the funnel to examine the percentage of candidates sourced from different demographics. You may find that a lopsided hiring system begins further back than you think, which is a sign that you need to change where and how you advertise your job postings and source your candidates. Revisit your job posting language to spot hidden biases, and try new job boards to expand your reach to populations that are underrepresented at your company.

A great way to further improve this metric is by tracking your job marketing campaigns. If you notice a spike in the types of candidates you’re looking for, check what campaign you were running at the time to see what worked.

Be especially aware of sourcing and internal recommendations. If you repeatedly dip into the same pool of people, your applicant diversity will stagnate very quickly.

A lot of our customers intentionally focus their sourcing outreach on candidates in underrepresented groups. That’s generally a very effective way to increase the diversity of your overall talent pool.

More to keep in mind as you implement

Of course, numbers don’t tell the whole story. You could write a book about making your hiring better and more inclusive (and many people have!) You’ll need to be on the look out for several other things in order for your investment in your DEI metrics to pay off for everyone.

Making these improvements is going to take time. You shouldn’t expect results overnight, and even setting up the analytics is going to take some time to do right. That means that you truly need buy-in from everyone involved. The executives at your company need to be as invested and as patient as your recruiting team. Get out ahead of any issues by presenting DEI metric tracking as a worthy time investment from the start, so that everyone is on the same page before you find yourself caught up in the process.

Focusing on improving your DEI metrics will come with tradeoffs. You may find that, when you dial in on metrics like improving stage to stage conversion rates for certain demographics or increase the percentage of underrepresented groups you hire, other metrics, like “time to fill” might go up. Remember that this is part of improving your overall hiring system for the long term. Because of these tradeoffs, buy-in from all levels is once again vital.

If your company has been around for a while, you may be using unofficial metrics to track diversity and inclusiveness. Now is a good time to revisit those. If your guidelines are particularly outdated this is the perfect time to toss them out and start fresh. The datapoints we’ve outlined above are going to be more fair, accurate, and definite than vague rules of thumb.

Ready to begin?

There’s no need to fear the numbers. Too many great companies hold themselves back from tracking DEI metrics because they’re nervous about not doing it right. Success is going to look different to different companies, and there are multiple types of diversity to consider in hiring. Don’t let that overwhelm you! Instead, let it empower you: everyone needs to start somewhere, and right now is the best time to do it.

Tracking your DEI metrics is the first step in a much larger process of making your business a more diverse, inclusive, equitable, and welcoming place to work. We hope that this guide will help you take on the challenge!

If you found this article helpful, bookmark it, then subscribe to our blog for future recruiting insights, stories, and how-to’s.