Recruiter Productivity | 2025 Talent Trends Report

12 minute read

Topics

Table Of Contents

In August 2023, we first released a selection of recruiter productivity metrics to better understand rapidly shifting recruiter priorities following years of rapid change in the industry. Below we’ve fully revisited each, extending the time windows from Q2 2023 to Q3 2024, allowing us to see what has or hasn’t changed in the 1.5 years since. We hope this helps talent teams develop a data-driven perspective on their 2025 recruitment strategy.

This report analyzes over 31M applications and 95K jobs from January 2021 through September 2024. Subscribe to our Talent Trends newsletter to receive a PDF copy and bite-sized insights in your inbox every week.

Report Highlights:

As a sneak peak, the primary changes observed in this latest analysis versus our original 2023 analysis include:

- After hitting a low of ~4.3 Hires per Recruiter per quarter by early 2023, the number of Hires per Recruiter in 2024 stabilized at around ~5.4 hires.

- In 2024, teams interviewed ~40% more candidates per hire for both business and technical roles than in 2021. We believe this is likely a reflection of the growing emphasis on Quality of Hire in 2025.

- Getting to the offer stage after interviewing seems to be getting more difficult, reflecting changes to the candidate’s experience.

Let’s dig into all of this further.

Part 1: The Recruiter Experience

Applications per Hire Tripled from 2021 to 2024

We first began by understanding both average Hire per Recruiter and Applications per Hire. Let’s start with the first (red line on chart below). By taking a blended average across role types…

- In our 2023 report, we noted a drop in the quarterly rate of hire from a high of nearly 7 in early 2021 to a low of ~4.3 by early 2023.

- Average Hire per Recruiter has since relatively stabilized, climbing from 4.3 in Q1 2023 to 5.6 a year later in Q1 2024. [Tweet This]

- From Q3 2023 to Q3 2024, we see an average 5.4 Hires per Recruiter.

The bars on this same chart represent average Applications per Hire.

- In 2023, we reported a large increase in the average number of Applications per Hire, seeing a ~120% increase from the baseline average in 2021 to 2023.

- Since then, Applications per Hire have sustained this increase. We now see a ~182% increase from the baseline average in 2021 to the past year of data analyzed (Q4 2023-Q3 2024). [Tweet This]

Overall, this data seems to indicate that more hires are starting to be made again within organizations, but the volume of people applying for those positions continues to be more than recruiters have had to historically manage in the hiring process — especially when looked at from the perspective of other changes we’ve reported on:

- In our Recruiting Coordination report, we observed that the volume of RCs per organization dropped starting in 2022, leaving talent acquisition teams to do more scheduling with less coordination support.

- In our Applications per Job report, we noticed a 2.6-3x growth in job applications at the start of 2024. Conversations with talent teams throughout the year indicated that managing inbound volume was a top challenge for the year — and led to the emergence of new technology to support, including Ashby’s AI-Assisted Application Review feature.

Let’s now take a closer look at average Hires per Recruiter, Interview Applications per Hire, and Interview Hours per Hire by job function and company size.

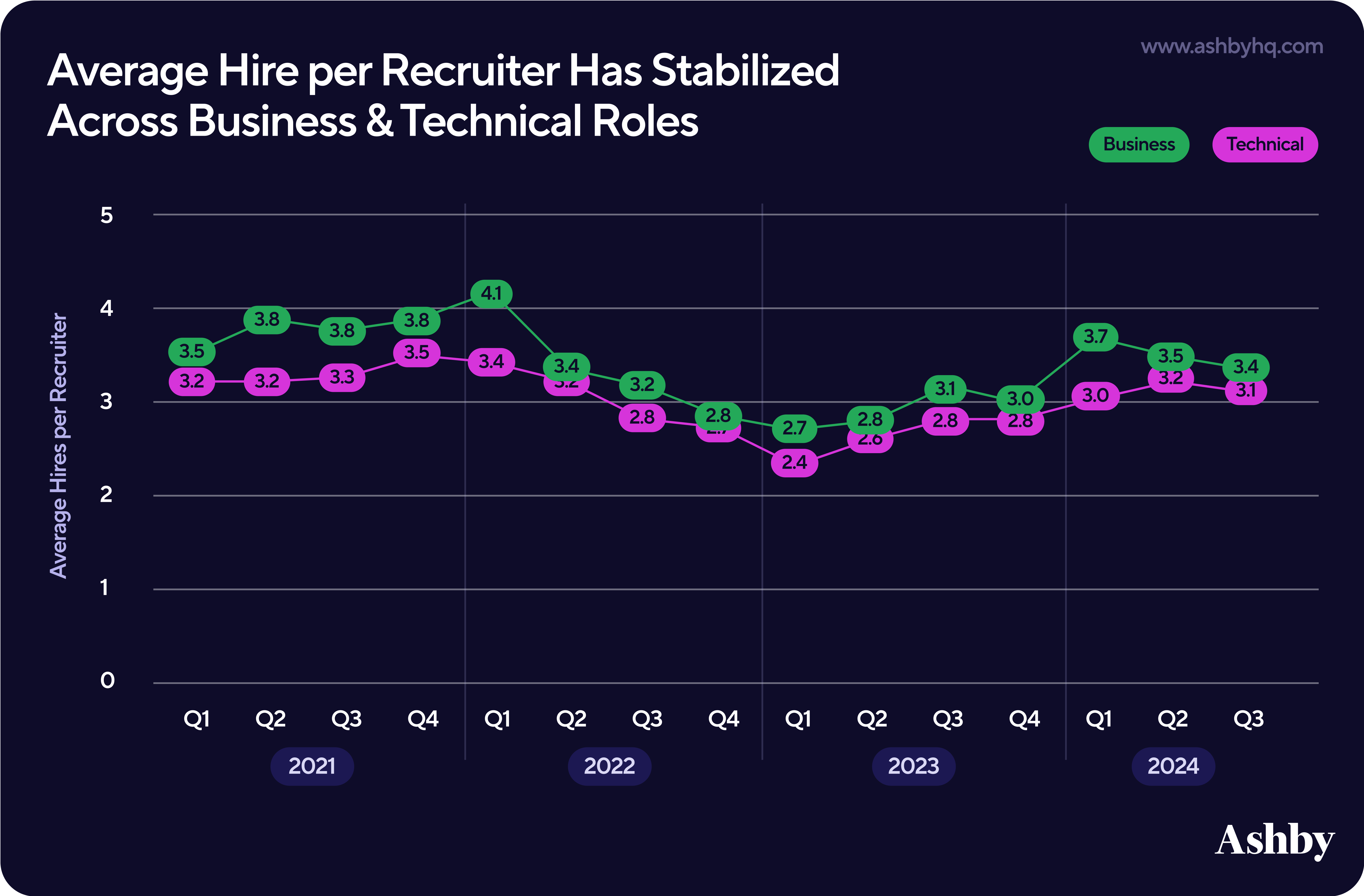

Average Hire per Recruiter has Stabilized Across Business & Technical Roles

We split average Hire per Recruiter by job function. While across both functions we see the same trend of Hires per Recruiter dipping from Q2 2022 through Q4 2023 and then rising again in 2024, we also see the average rate of hire for business roles remained higher per quarter than technical roles over the full time series.

Applications Interviewed per Hire Metrics

Teams Interviewed ~40% More Applicants in 2024 than 2021

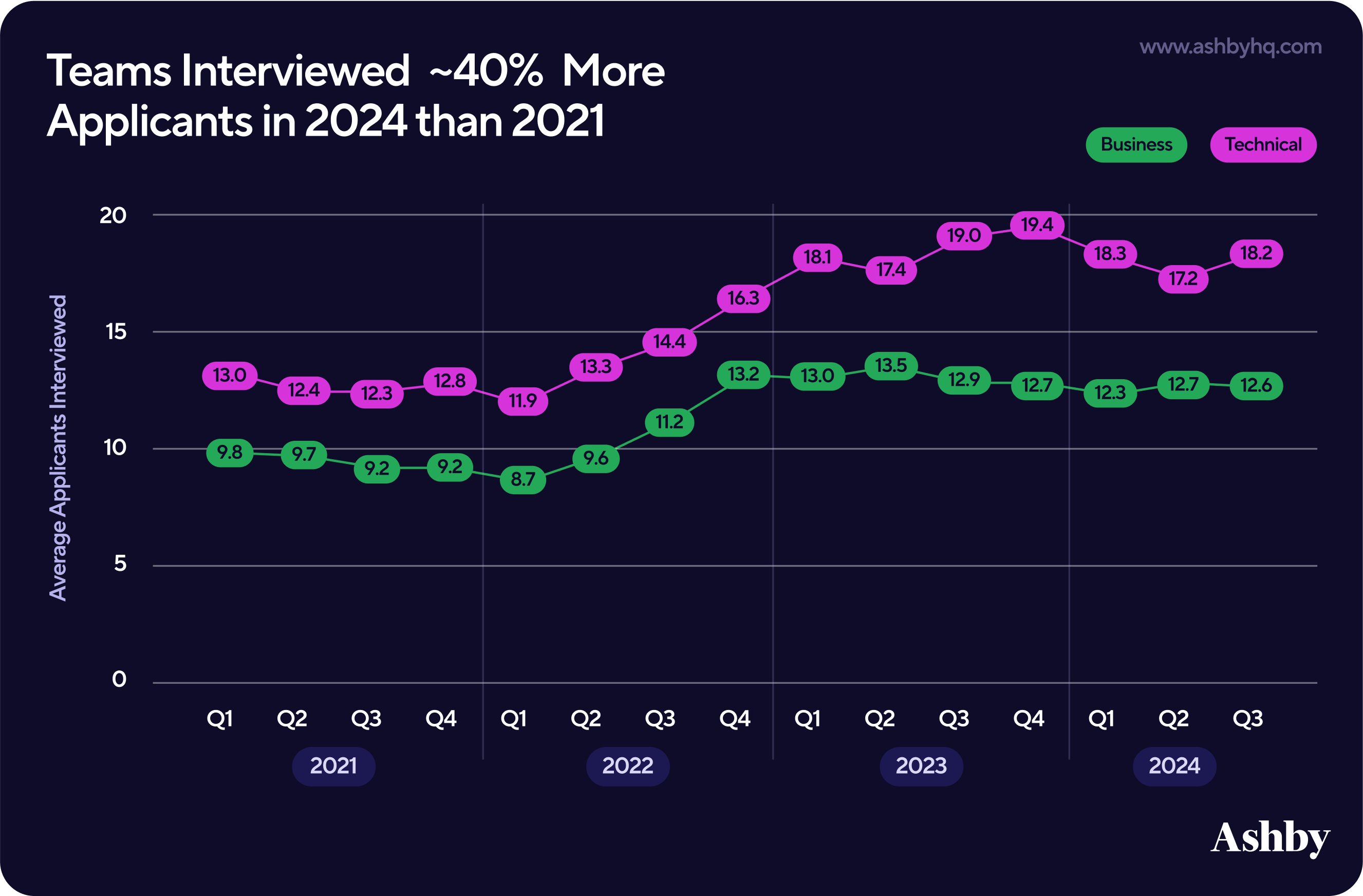

Sticking with job function breakouts, let’s now dig one layer deeper from the overall hires per recruiter to now the average Applications Interviewed per Hire (e.g. number of candidates interviewed to hire the role).

- Throughout 2021, the volume of interviews per hire was largely stable.

- From Q2 2022 through Q1 2023, the average number of Applications Interviewed per Hire began rapidly increasing, and have since plateaued. Overall, the cost per hire in terms of recruiter time has increased as more applications are interviewed per hire than before.

- In 2024, teams interviewed ~40% more candidates for both business and technical roles than in 2021. [Tweet This]

- That said, technical roles require more applications interviewed per hire overall than business roles.

Operations & Product Management Roles Have the Most Applications Interviewed per Hire

When segmenting this same data by job role, some interesting observations emerge.

- Overall, more technical applications make it to interviewing than business applications.

- Within business roles, Operations sees the highest average applications interviewed per hire at 20.8, while Customer Support sees the lowest at 8.5. [Tweet This]

- Within technical roles, product management sees the highest average applications interviewed per hire at 20.6 and Design has a low of 15.3.

Interview Hours per Hire

Next we'll use these same frame of references (job function, company size) to look at Interview Hours per Hire.

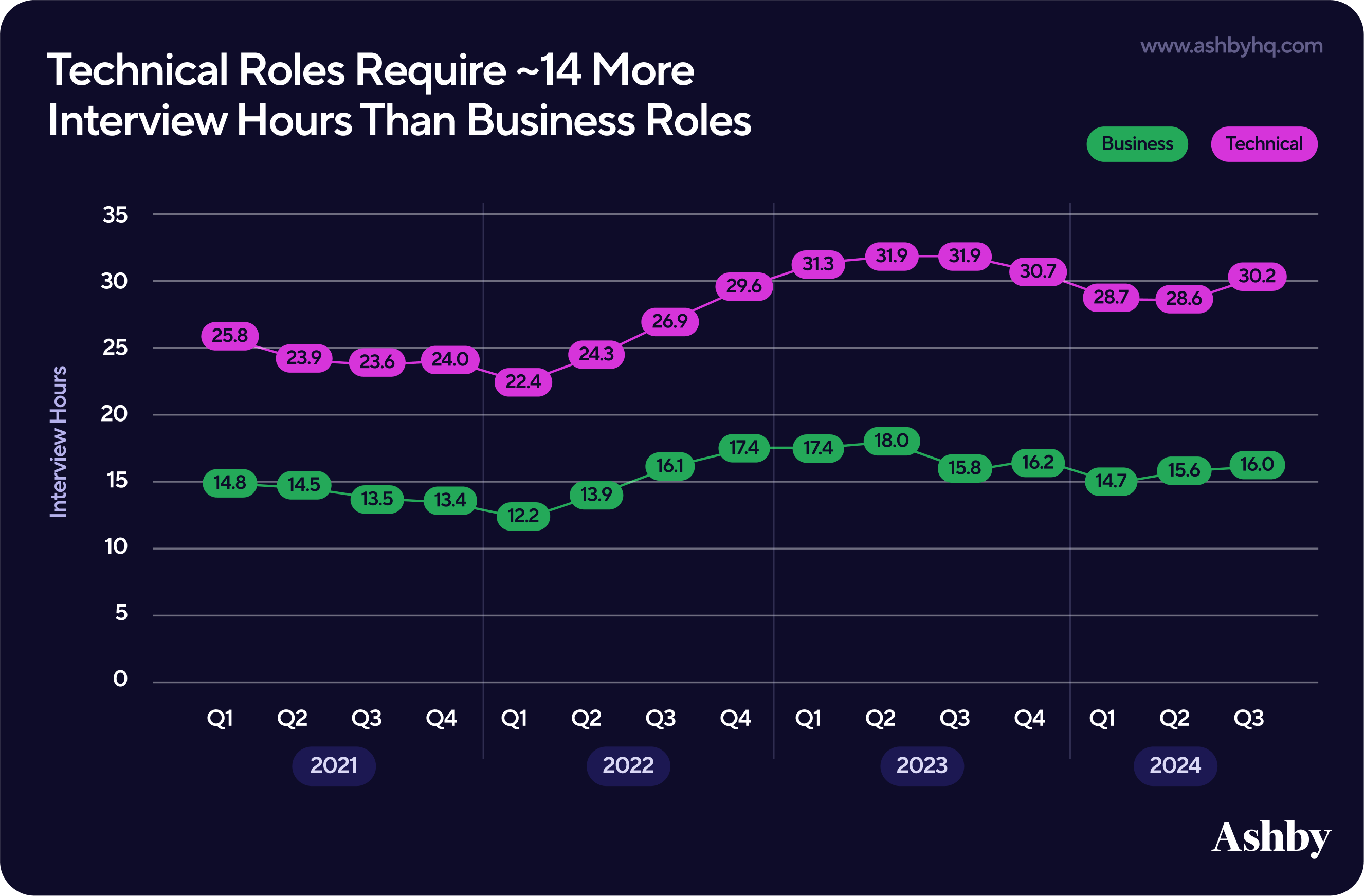

Technical Roles Require ~14 More Interview Hours Than Business Roles

Let’s start by understanding how much time recruiters are investing in interviews per each hire made. Overall, we see a similar story here as we did for average applications interviewed:

- Interview Hours per Hire jumped ~1.3x in 2022 and remained in 2024, on average, 21% higher for technical roles and 6% higher for business roles than in 2021. This indicates that overall hiring processes have become increasingly time-consuming.

- It takes roughly ~14 more interview hours to close a technical hire than a business hire.

In anecdotal conversations with the hiring teams we speak to daily, Quality of Hire continues to be a huge focus for teams. This is a stark change from the 2021 market of “hire at all costs,” which may be what we’re seeing visualized in these charts.

Quality of Hire in Ashby: Talent teams can use Ashby to survey hiring managers on a customizable cadence (e.g. 30/60/90 days of onboarding) to complete new hire assessments. The surveys themselves are lightweight, while the data collected provides a powerful source of truth for what channel sources, recruiters, or other factors lead to quality candidates and ultimately hires. Learn more here.

Customer Support Roles Have the Fewest Interview Hours per Hire

Breaking out Interviewer Hours per Hire by role, we see again that Operations and Product Management remain dominant in the number of interview hours required per hire, at 28.1 and 33.6, respectively. This data also seems correlated with Applications Interviewed per Hire, which intuitively makes sense: More applications interviewed per hire should mean more interview hours invested per hire.

Part 2: The Candidate Experience

Up until this point, we’ve looked at recruiter productivity metrics from the perspective of the recruiter. Understanding productivity from the perspective of potential candidates can be just as valuable. This section will highlight how the candidate experience has or hasn’t been impacted by changes in recruiter priorities and workloads.

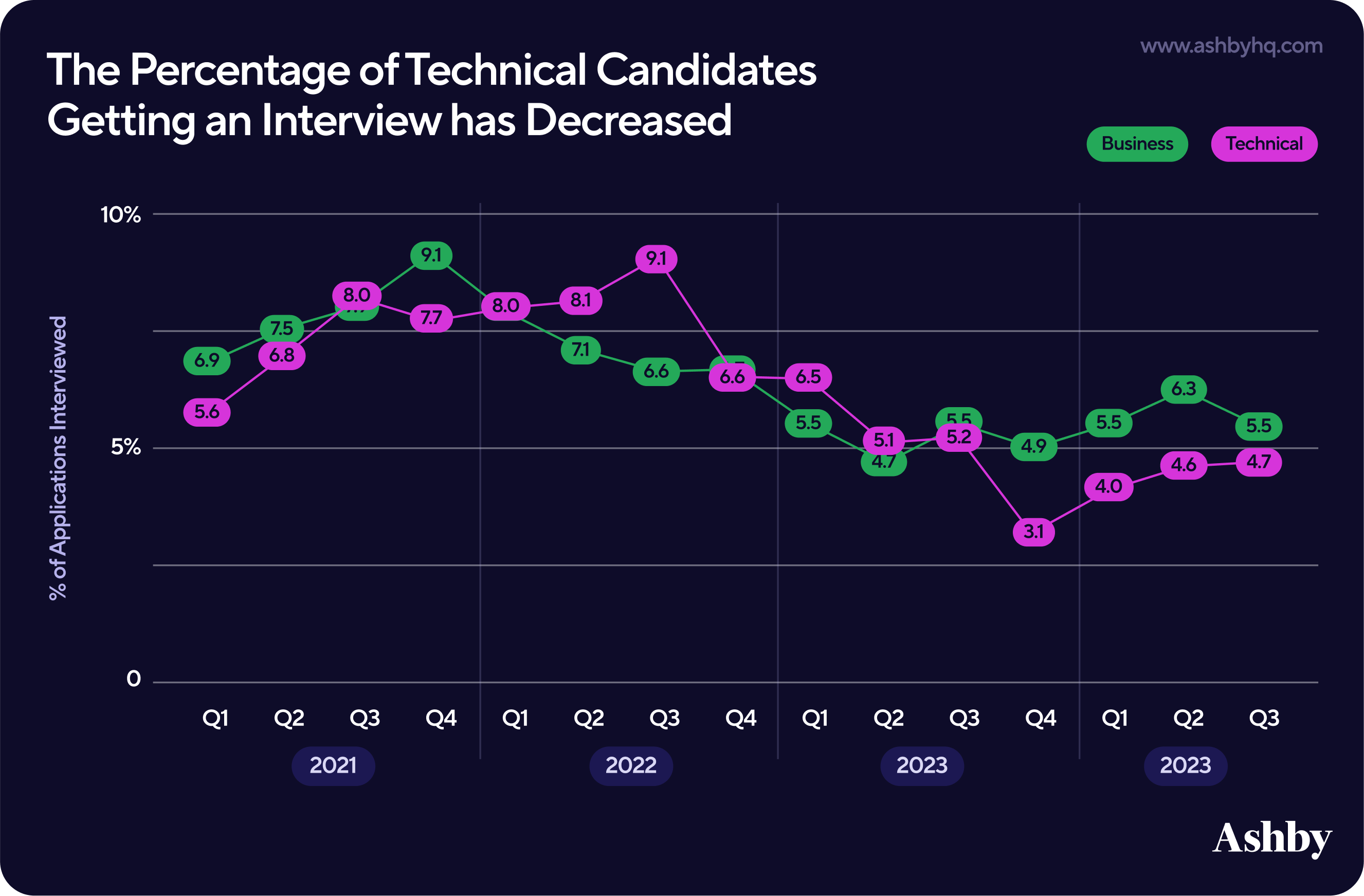

The Percentage of Technical Candidates Getting an Interview has Decreased

For technical candidates, even with the increase in hours interviewing by recruiters, the percentage of candidates that get an interview has decreased over time, though the past three quarters have been greater than the 2023 low. Meanwhile for business roles, the Application to Interview Rate seems to be steady over the past two years after a drop from 2022 levels.

The Rate of Interviews to Offer was More Stable in 2024

Even more difficult than getting into an interview process is getting an actual offer.

- In 2023, we reported an all-time low of ~7% of technical candidates and ~9% of business candidates interviewed making it to job offers.

- While this began to rapidly increase for business roles in Q3 2023 (right after our last analysis), by Q3 of 2024 the rate seems to be somewhat stable, though lower than the 2021 high.

This becomes particularly interesting when comparing to our Offer Acceptance Rate report, where we observed that 2023 exhibited the highest average Offer Acceptance Rate for the years we’ve analyzed to date at 81%. In other words, it seems getting an offer is increasingly difficult and those who get there are more likely to accept.

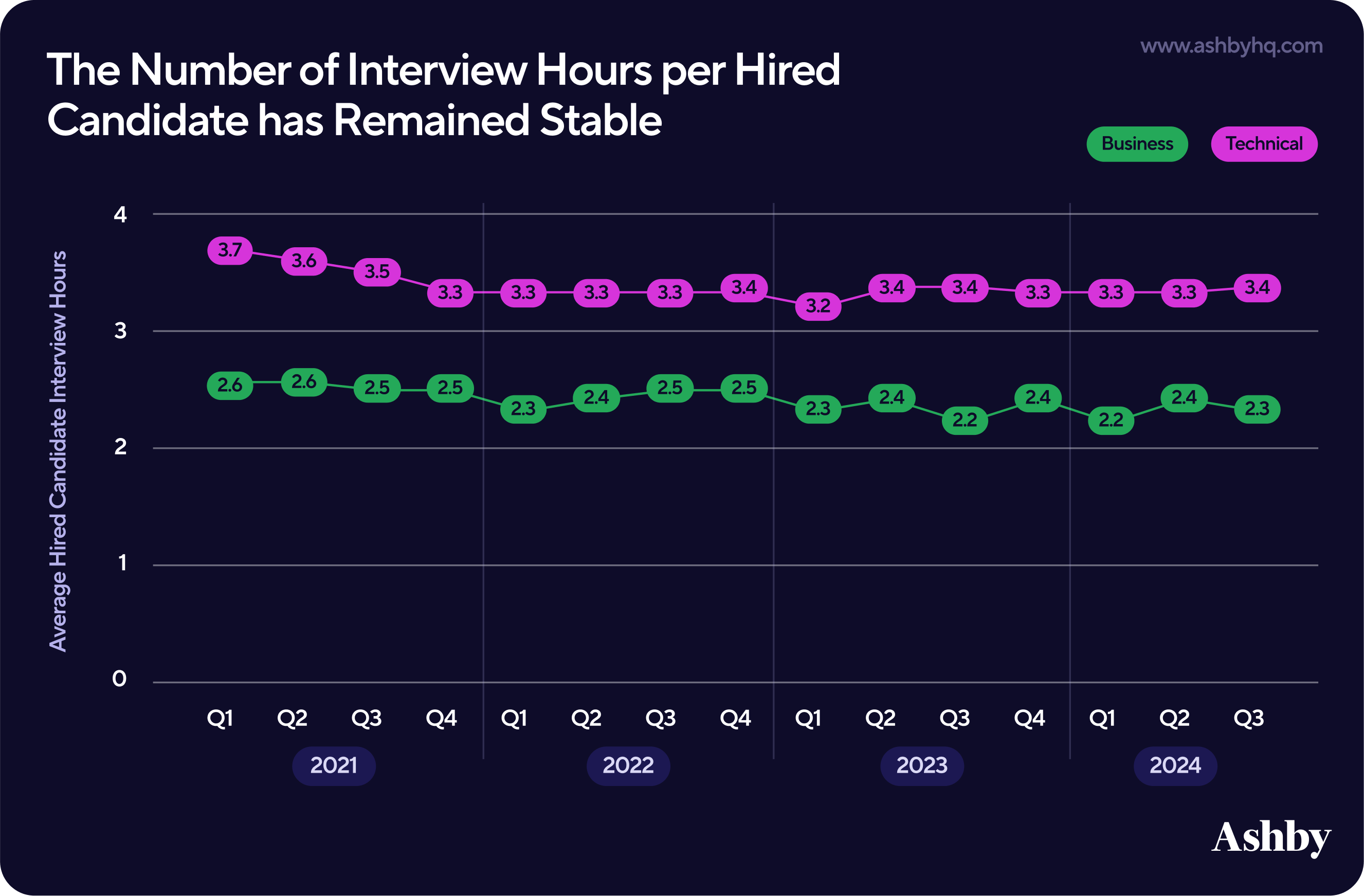

The Number of Interview Hours per Hired Candidate has Remained Stable

We began this part of the analysis by observing interview hours required on the part of the candidate. Despite recruiters investing more interview hours and having to review far more applications, the successful candidate is not being asked to interview more for that role. Average Interview Hours per Hired Candidates has shown no significant changes over the 3.5 year period analyzed.

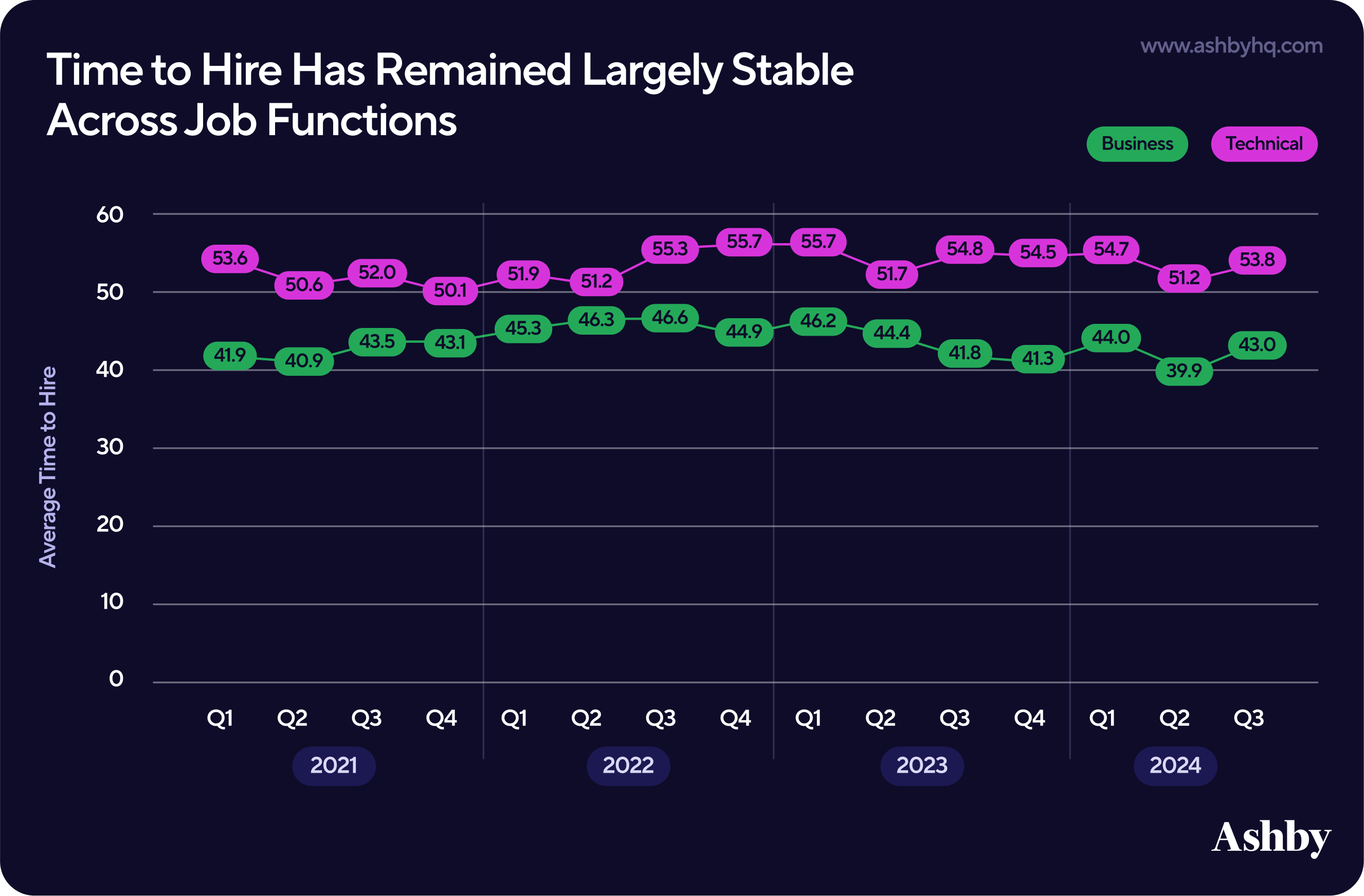

Time to Hire Has Remained Largely Stable Across Job Functions

Similarly, Time to Hire has also been very stable over the past 3.5 years. That said, it’s important to include some commentary here around how Time to Hire is notoriously skewed for various reasons. A hiring effort can be paused, restarted, require a new job description to make a hire, and so on. All of this can lead to some applications marked as being hired far faster than they actually took to hire or dragging some processes out for months when in fact, there was an intermediate pause in the recruitment process.

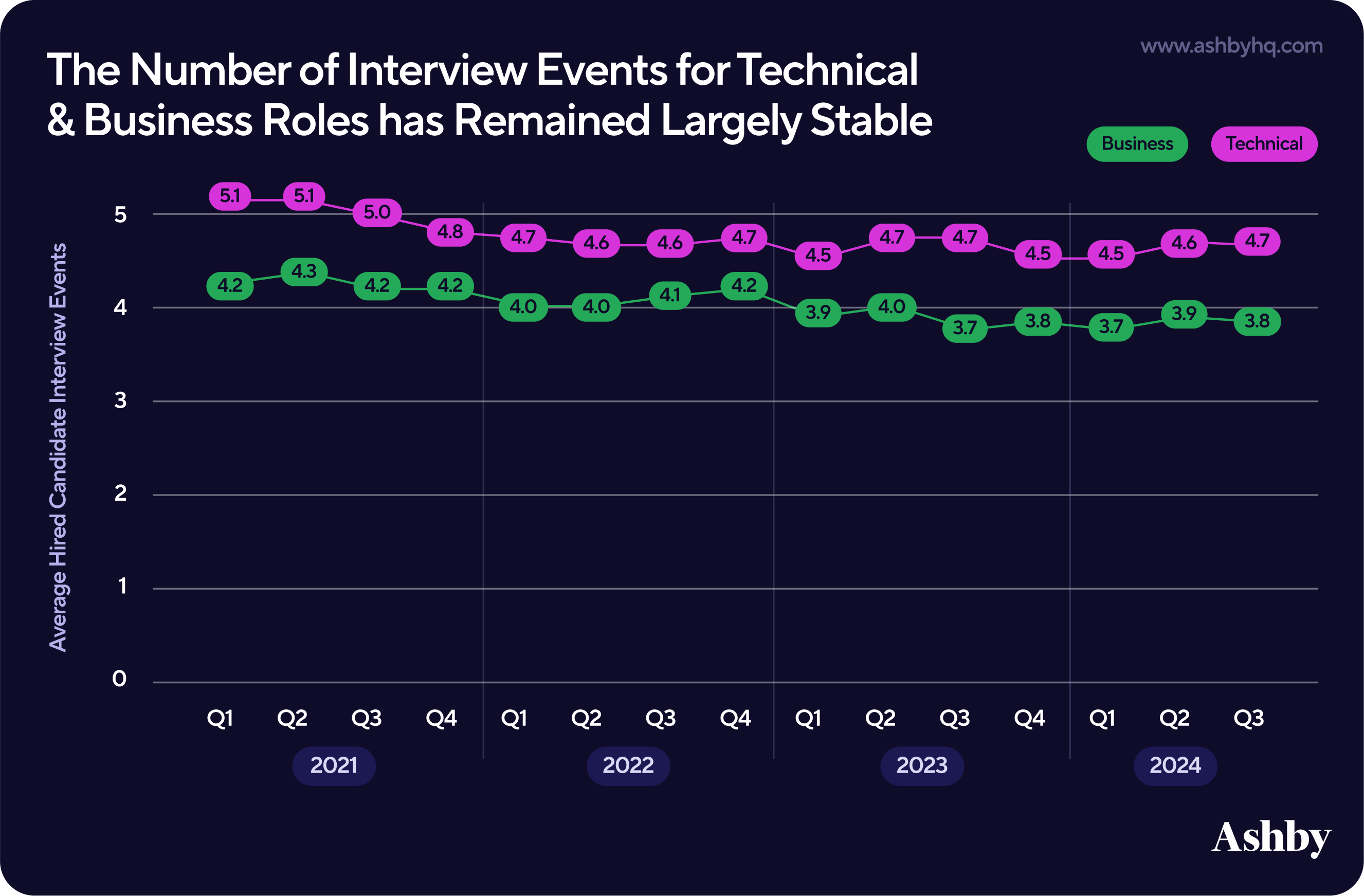

The Number of Interview Events for Technical & Business Roles has Remained Largely Stable

To remain thorough, we also looked at the average number of interview events a hired candidate has had to experience in light of the increased volume of interview hours per recruiter. Fortunately for job seekers, the average number of interview events also remained stable.

Breaking this out by function we see that over the 3.5 year period analyzed:

- Hired technical candidates experience an average of 4.7 interview events.

- Hired business candidates experience an average of 4 interview events.

So up until this point, we’ve learned that the hired candidate’s time investment per individual job has remained the same while the recruiter’s time investment to fill that same job has increased significantly. That said, getting an interview and making it all the way to the offer stage has become more difficult.

A Note to Candidates: Of course, we recognize that outside our analysis there are other factors impacting today’s talent pool. In fairness to those actively on the job market, we hear the constant concerns shared online that there are far more people looking for work than in years past. So while our analysis shows that the amount of effort per role has not changed, we have heard that it takes applying to more jobs than ever before to ultimately get hired while our data shows that getting to that final offer stage is becoming harder and harder.

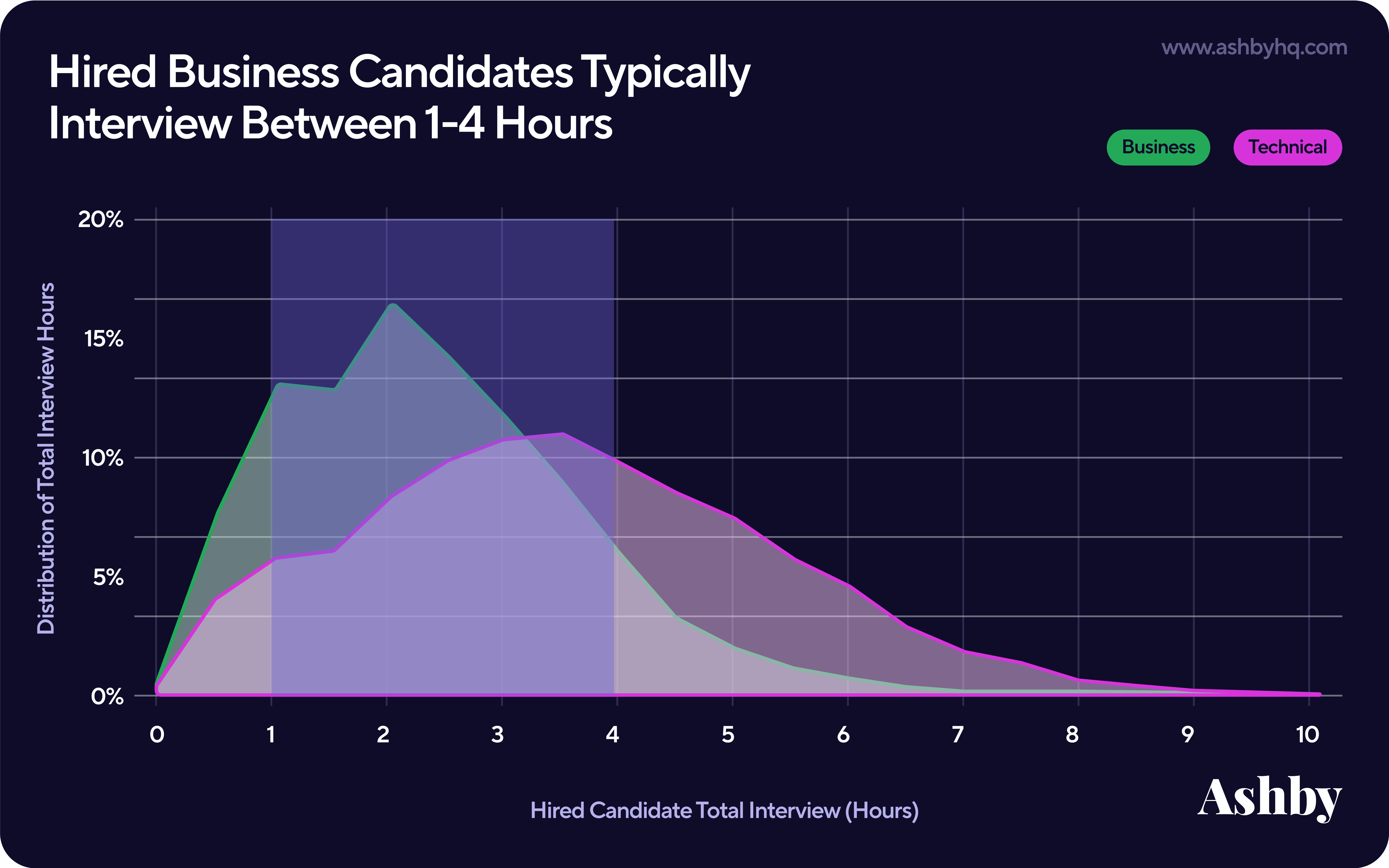

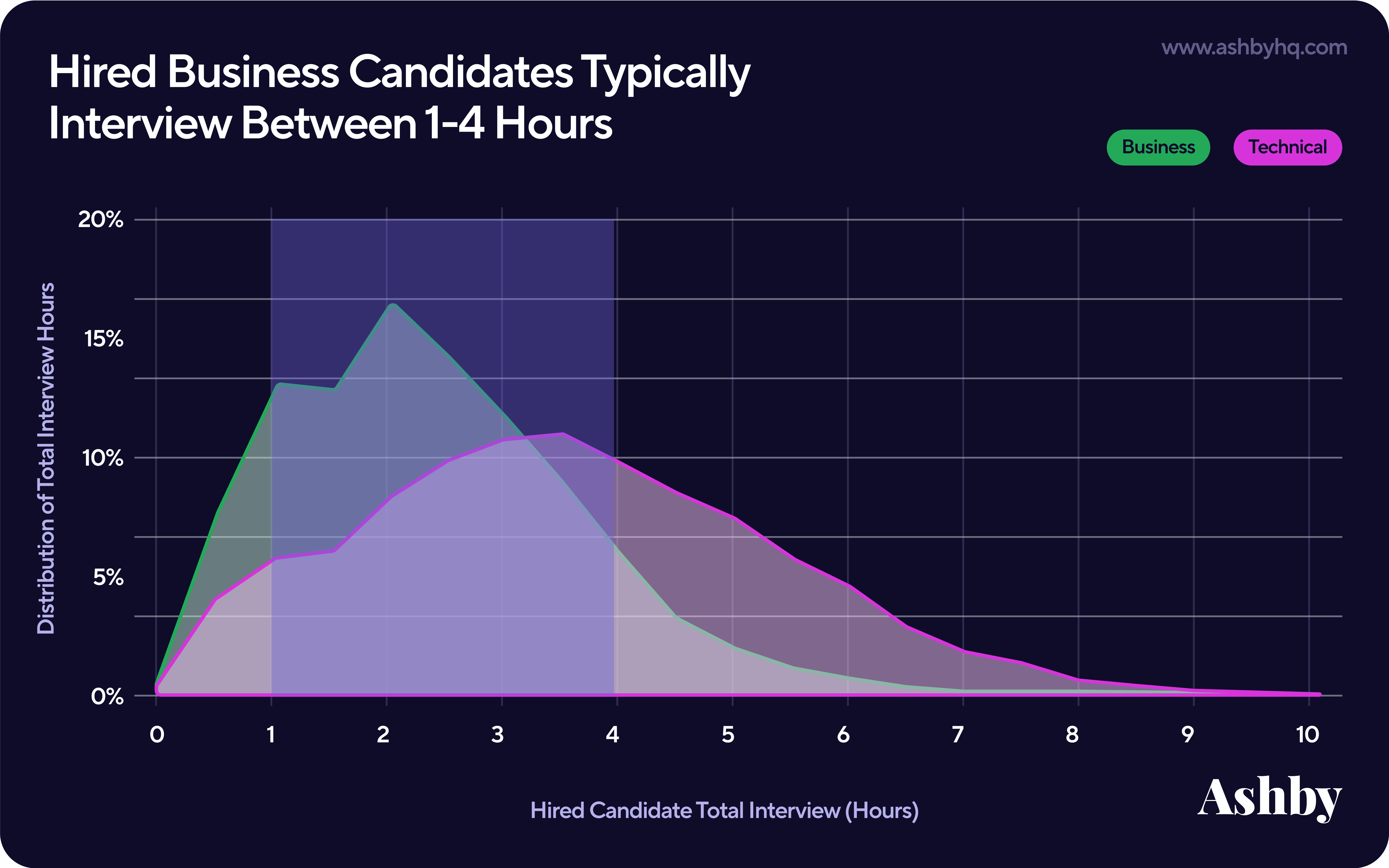

Hired Business Candidates Typically Interview Between 1-4 Hours

Finally, we observed the total hours of interview time a hired candidate experiences. This chart visualizes the hours that go into interviewing before vacancies are filled. Since the distribution for technical candidates is more spread, we can infer that the candidate experience for hired technical applicants may be more varied than business roles, which are concentrated between 1 and 4 hours [Tweet This]. Some specifics for business roles:

- 13% of business candidates are hired after going through 1-1.5 hours of interviews.

- 16% of business candidates are hired after going through 2-2.5 hours of interviews.

As this metric has a long tail, it’s helpful to look at the median and middle 50% range for a representative benchmark, which is provided below.

Part 3: Traditional Recruiting Metrics

We conclude our analysis of recruiter productivity by taking a look at some metrics recruiting teams have historically tracked in reporting workflows.

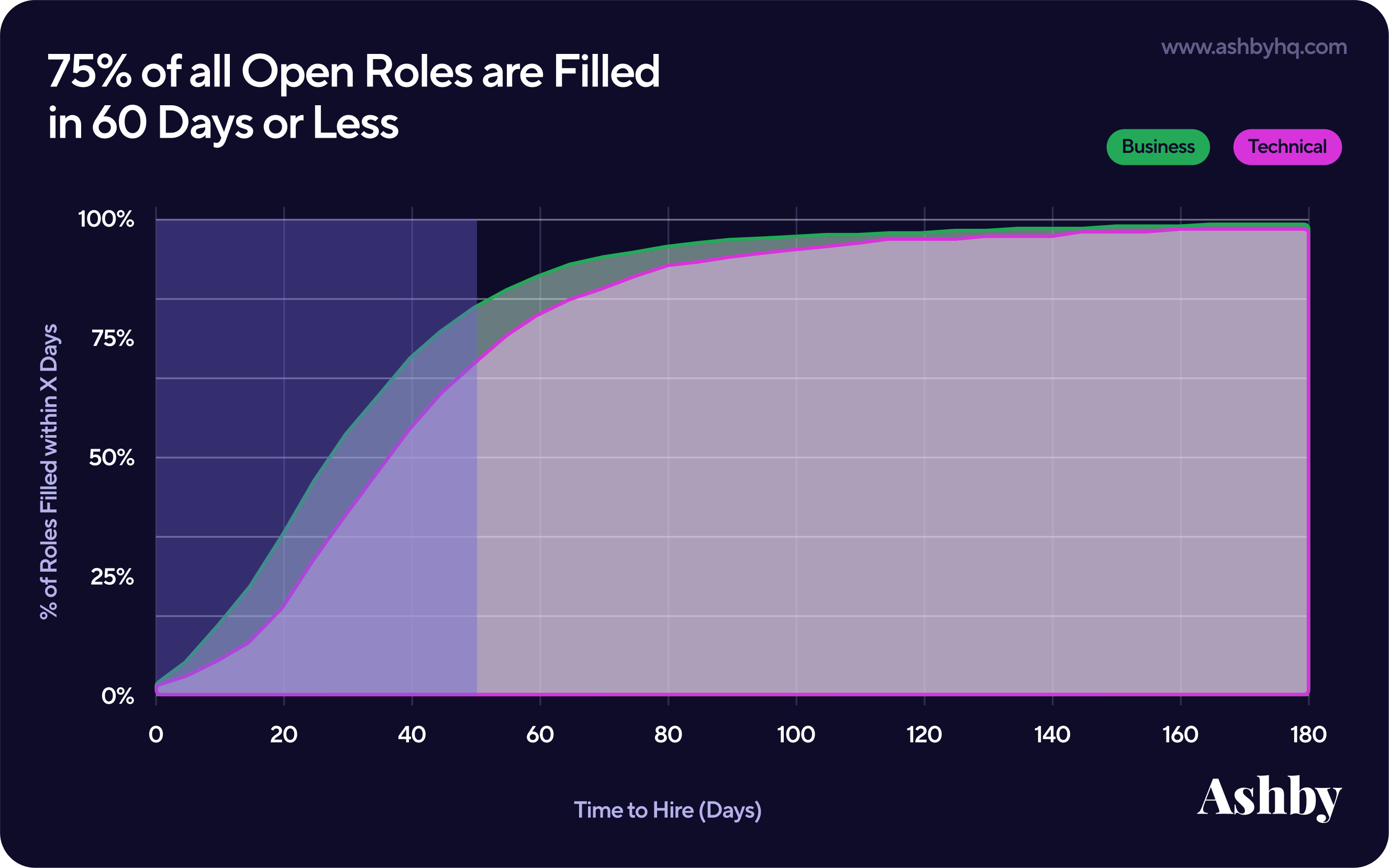

75% of all Open Roles are Filled in 60 Days or Less

Time to Hire is a traditional recruitment metric that measures the number of days between a candidate applying for an open position and that same candidate accepting a job offer. Looking at this by functional job openings, we can see over the past two quarters that:

- 75% of technical roles are hired within 60 days or less while 75% of business roles are hired within 50 days or less. [Tweet This]

- In other words, it takes roughly 10 days longer to fill the preponderance of technical positions in comparison to business positions.

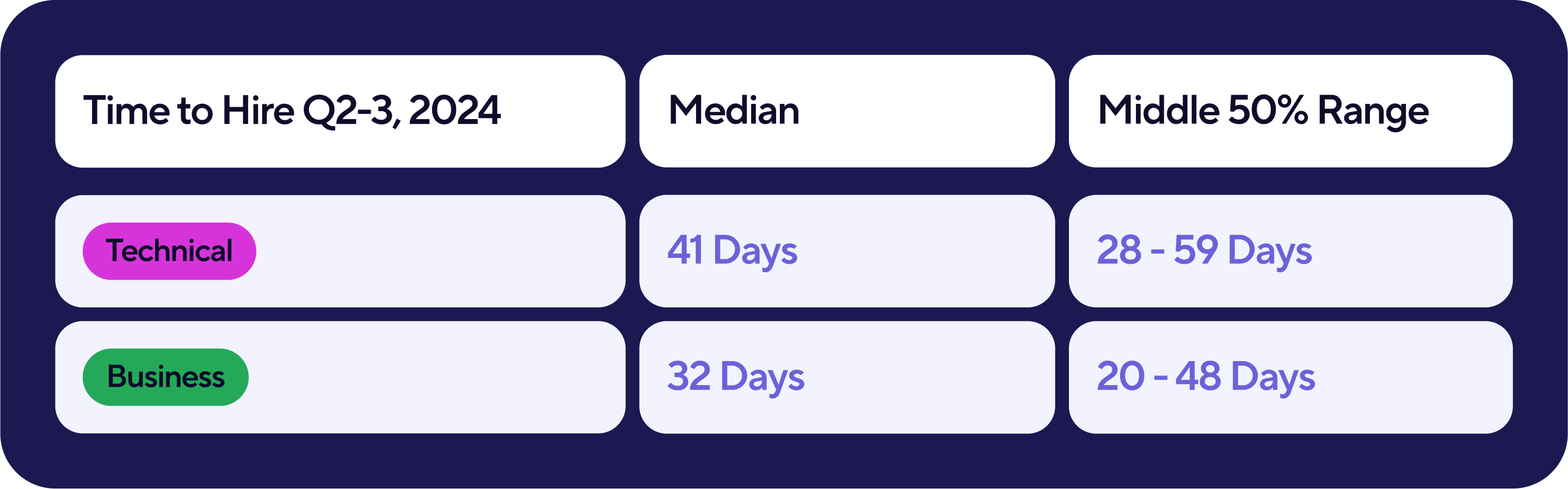

Given again the long tail associated with Time to Hire, we highlight the median and middle 50% range in the table below, showing a median of 41 days for technical roles and 32 days for business roles.

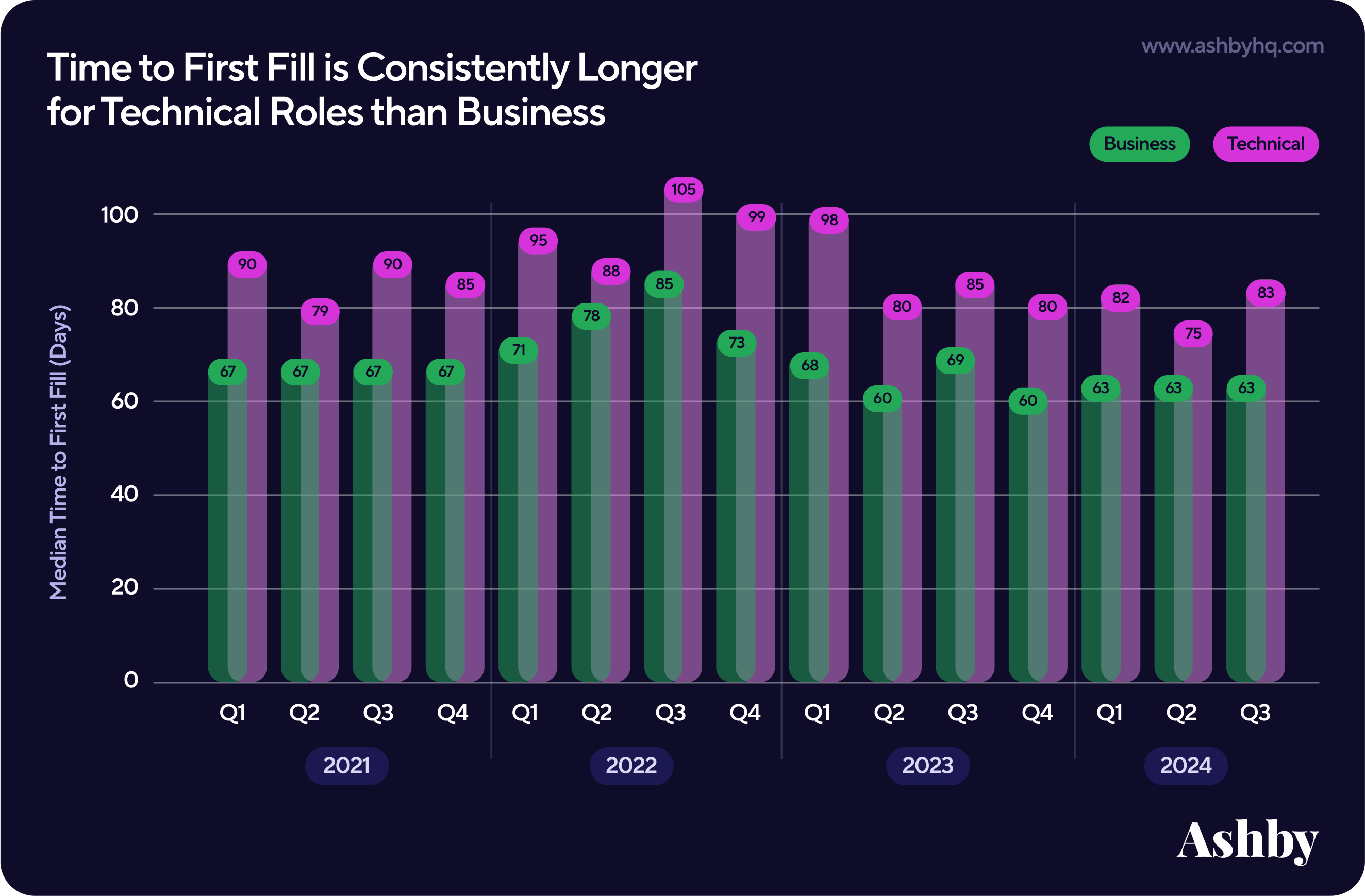

Time to First Fill is Consistently Longer for Technical Roles than Business

Since Time to Fill (TTF) is a notoriously difficult metric to measure, we estimated it by looking at Time to First Fill. In other words, the time from when a job was opened to when the first hire was made. We see this metric as imperfect, preferring actionable and real-time Modern Recruiting Metrics, but recognize it can give signal on what it may mean to open a new role for the first time and begin hiring efforts.

Our observations found that Time to Fill has remained steady overall with some slight turbulence in average time starting Q2 2022 and ending Q2 2023.

- In Q2 2022, Time to Fill jumped to 104 days for technical roles and 85 days for business roles.

- By Q2 2023, it dropped to 80 days for technical roles and 60 days for business roles.

- Across the full timespan, we observe an average 88 days for technical roles and 68 days for business roles. Technical roles consistently take 10-20 days longer to fill than business roles. [Tweet This]

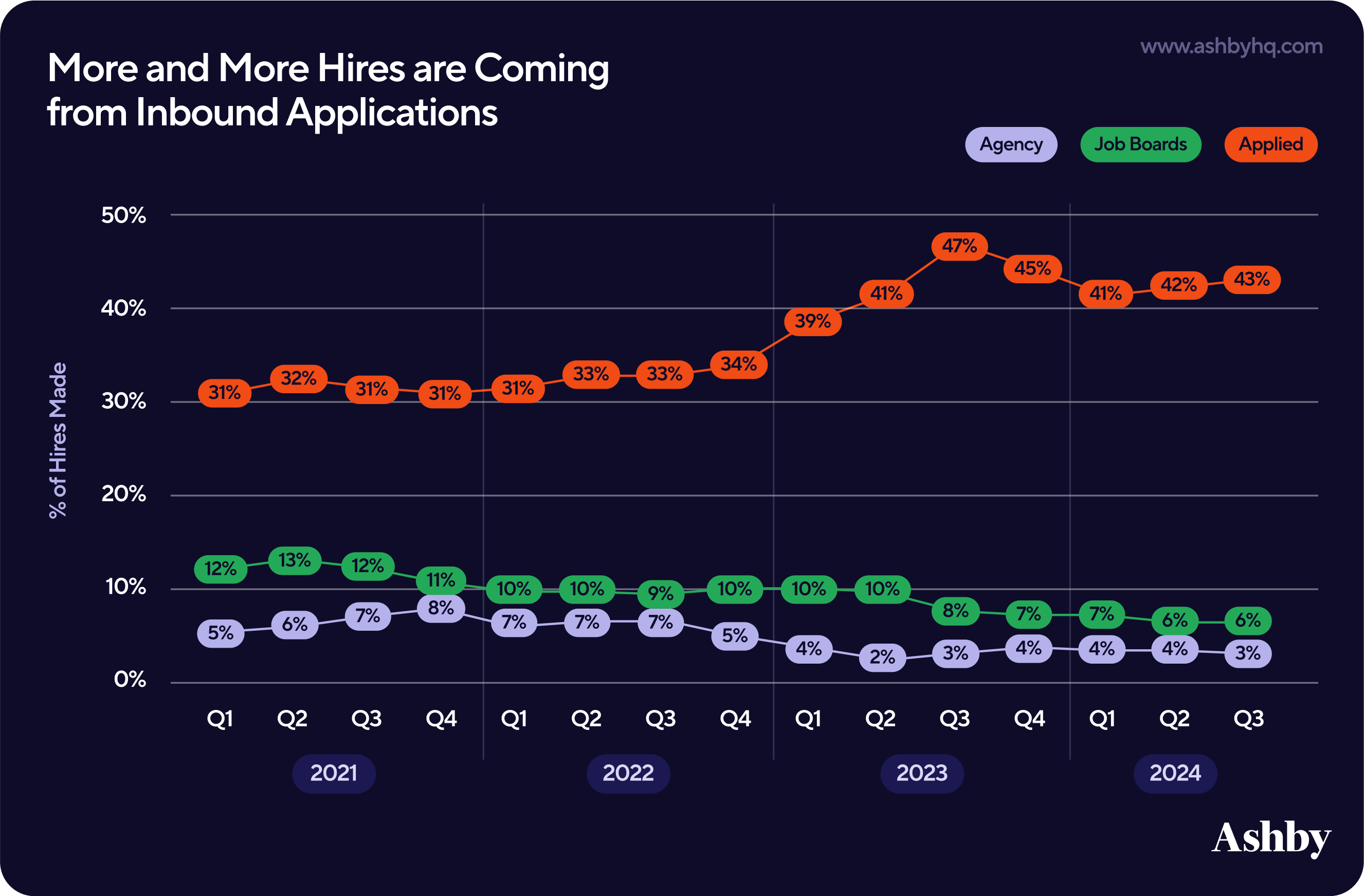

More and More Hires are Coming from Inbound Applications

We previously analyzed accepted offers by source, seeing that more and more hires are made from direct applicants. As we extended the time series for this report, that trend still stands.

- The fewest percentage of hires come from agencies and external job boards, with the latter decreasing since we last reported on it (hires from job boards in 2024 are half of what they were in 2021). [Tweet This]

- The most hires come from inbound applications, which saw a peak in Q3 2023.

All other source categories were excluded from this chart for visual clarity, but the remaining ~48% of hires come from sources such as sourcing, referrals, and internal transfers. For a closer look at various sources of hires, refer to this chart in our Offer Acceptance Rates report.

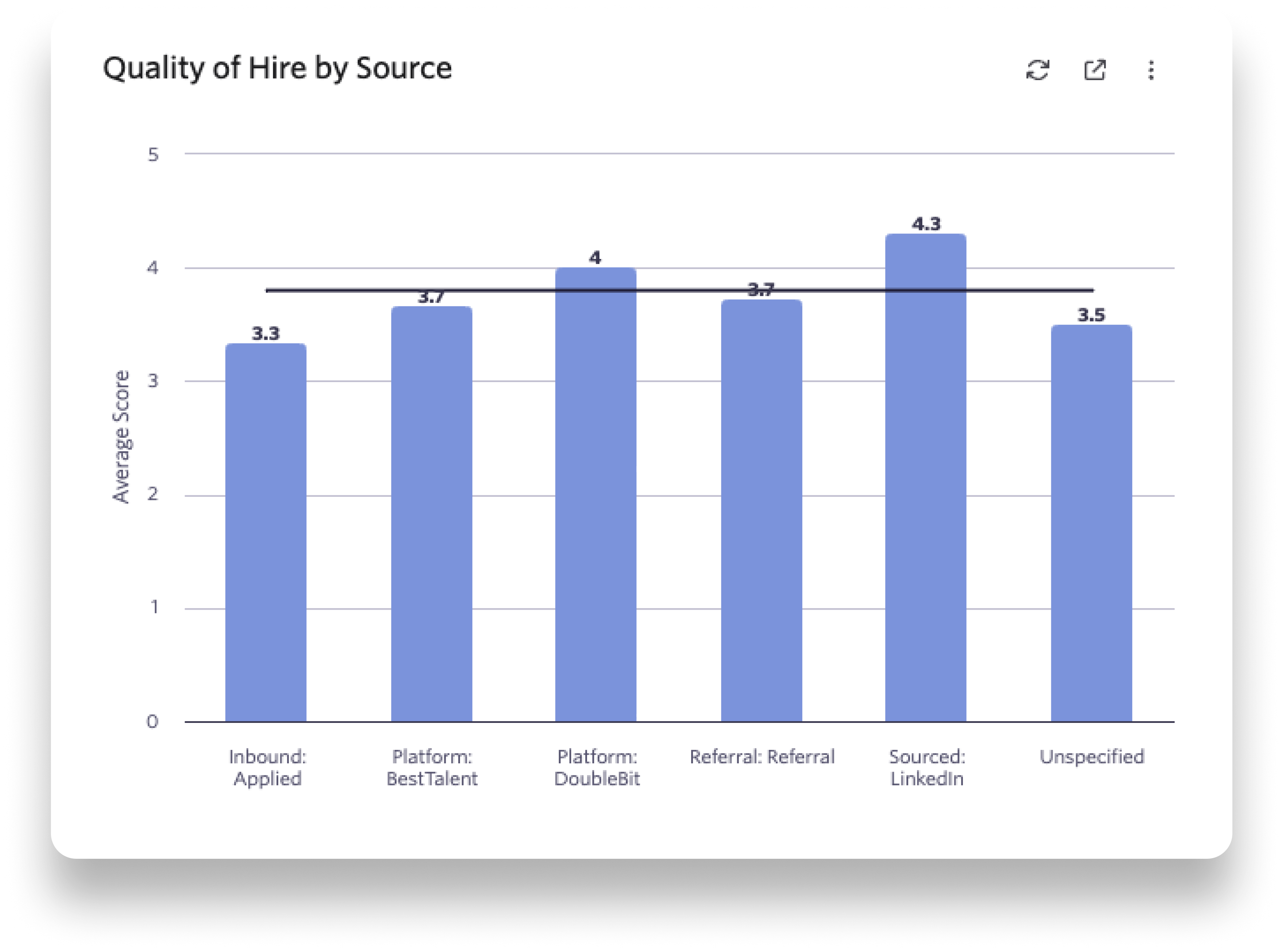

Using Quality of Hire to Analyze Source of Hire

Of course, sources of hire can sometimes vary from where qualified candidates are found. One of our favorite parts of using Ashby is comparing our Quality of Hire data against metrics such as Source of Hire to better understand: Of candidates coming from various sources, which are ultimately performing strongest in seat? The sample chart below shows, for this example scenario, that new employees from applied inbound sources had the lowest Quality of Hire score (3.3 out of 5).

This sample scenario shows instead that the best talent is coming from sourced candidates on LinkedIn. This chart could look very different from company to company or even pending the actual job opening — for example, engineering having a stronger QoH score for one source while marketers may have a stronger QoH score from another source. Consider requesting a demo of Ashby (or if you’re already a customer, ask your CSM!) to see Quality of Hire in action.

Conclusions

Through analyzing over 31M applications and 95K jobs from January 2021 through September 2024, we ultimately found:

- There are far more job seekers applying to new roles posted, as seen through Applications per Hire tripling from 2021 to 2024.

- Technical recruiting comes with a host of extra investment, with more average applications to review, more interview hours per hire, and longer time to fill.

- Despite increased workloads on recruiters, talent teams have continued to prioritize the candidate experience.

We hope these insights provide valuable guidance for talent acquisition teams to adapt to evolving trends and thrive in a competitive talent landscape. For more recruiting insights and benchmarks, subscribe to our Talent Trends newsletter.

Other Reports

Recruiting Coordination | Talent Trends Report

An analysis of 2.8M candidates for over 5.1M interview events.

2023 Trends Report | Applications Per Job

Analyzing 13 million applications from January 2021 - April 2023 to surface key patterns around applications per job per week.

Subscribe for more talent trends and insights

We will be regularly releasing new reports around trends and insights we're seeing in our data and you will be the first to know.